Whisky as an investment

Cask whisky is a unique commodity in that it is one of the only assets that increases in value as it ages. As whisky matures in the cask, it softens and takes on flavours from the oak, becoming more desirable and more valuable.

Whisky bottles also typically increase in value with time, as annual returns for investment in rare whisky bottles are around 8-10%.

How we can help you

Our experts have spent years building up the relationships with the distilleries to ensure that we can not just make sure your cask is stored in premium conditions, also that we know what whiskies deliver exceptional returns.

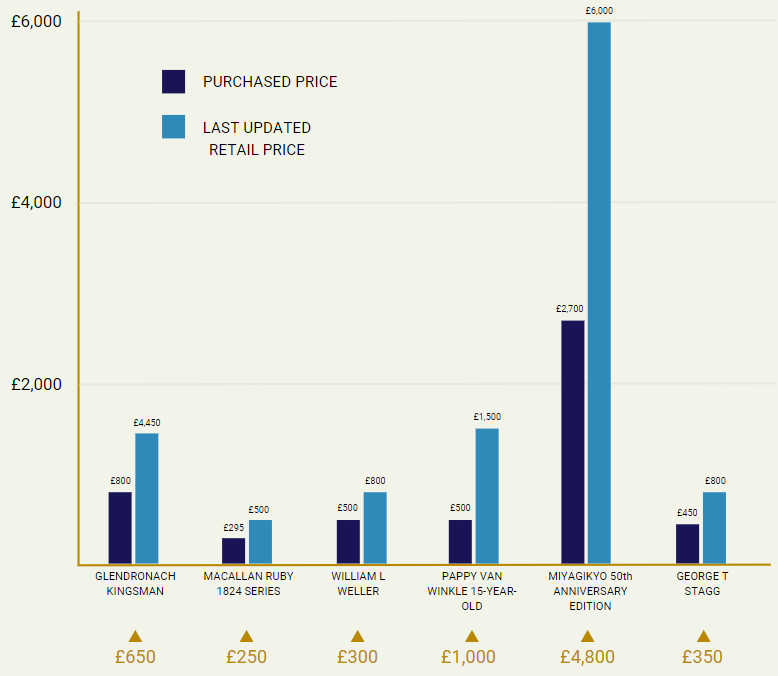

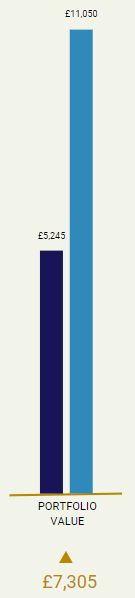

Portfolio Example 2019 - Now

With so much to consider such as region, cask types, history, pedigrees and many more factors.

Many distilleries have had to close over the years which led to major losses of investor’s assets. Without proper guidance and knowledge, it’s hard for you to know if your money is safe.

At the point of exit its hard for individuals to know which access points to exit are open to them and what’s the best way to maximise profit.

If a cask drops below 40% alcohol it can no longer be called whisky and your entire investment is worth zero. This happens due to the natural evaporation of liquid from the cask which occurs at a rate of around 2% of total volume per year. Thanks to the relationships we have built with the distilleries and warehouses, we can ensure that your barrels are closely monitored.

When purchasing a cask there are many factors you need to consider including the barrel type, taxation, LPA (Litres of Pure Alcohol), and how to re-gauge the cask to name just a few.

WHAT MAKES CASK WHISKY

DIFFERENT TO YOUR

TRADITIONAL INVESTMENTS?

This is a tangible investment, that is not correlated to the financial markets

It is a naturally appreciating asset. Looking at the market you will never find a 5-year-old whisky being more expensive than a 10-year-old whisky from the same brand

There is a degree of tax efficacy to the investment also:

When buying the cask there are no VAT or duty to pay, as the casks are being bought under bond. Only when the casks are taken out of bond (for example bottling to be sold) do you ever have to pay this. 99.9% of our clients will not use this as an exit and will just sell the cask under bond to avoid these costs

You are the full beneficiary (owner) of the cask

We are showing our clients growth of between 10-14% per annum and with the massive increased global demand of whisky, we also feel that this is a very conservative estimate

The Whisky Market at a glance

Market Performance

The whisky market globally will increase at a CAGR of 6% according market research firm Fact MR between 2021 and 2031 taking the value from $60 billion dollars in 2021 to $108 billion over the next 9 years. This up from a CAGR of 4% between 2016 and 2021. (Spirits business magazine 2021)

CASK WHISKY INVESTMENT

Whisky investment have historically generated excellent returns. With an average annual growth of around 10% to 15% and even higher rates on blue chip casks, your investment is always gaining value as a tangible asset

Cask Whisky naturally gets better with age, meaning you will always get a return of at least 9% per annum from the natural process of maturation

Easily liquidable asset – There are many markets across the world that are in search of Scotch or Irish whisky for blending purposes or investment purposes. This means it’s easy to exit and The Vineyard makes that journey easy with our many contacts. See here to learn more

Limited supply – Whisky, on a global scale, is growing at a rate that has been unseen for years. Casks are becoming increasingly harder to obtain as distilleries plan for the future and that lack of aging whisky available. The Vineyard has access to single malt casks of maturing and new make spirits, which means investing through our platform guarantees you entry to this closed market

BOTTLED WHISKY

Since bottles don’t naturally appreciate with age, we turn to bottles that are collectable and rare. For bottles to be considered collectable there are a number of factors that must be fulfilled. A simple rule of thumb is look out for bottles that are from a blue chip distillery, have limited-edition status, boast great critic reviews or are an inaugural release from a new distillery

Unlike casks, bottles are easier and cheaper to store correctly. You can store your bottles in our warehouses to keep them insured, secure and in the best condition

A FINE WINE SOCIETY

Speak to us about investing

or call us here: +44 0203 834 9513